Investments in Digit, IIFL Finance, CSB Bank, NSE, Fairchem Organics and 5paisa have generated excellent returns for Canadian company Fairfax Financial Holdings (FFH), generating a compound annualized return of over 20%.

Digit gave a whopping return (compound annualized) of 61.9 percent (as of end-December 2023) on the $154 million investment made in February 2017. Fairfax owns 49 percent of the general insurer’s shares. The fair value of its investment in the company was $2.265 billion at the end of December 2023, according to the FFHL annual report.

Fairfax India’s investment in the National Stock Exchange earned it a return of 33.4 per cent. It had acquired 1% of the capital of NSE for $27 million in July 2016. The fair value of this investment was $189 million at the end of December 2023.

-

Read also : Fairfax commits to provide $200 million in liquidity support to IIFL Finance amid RBI ban

All Fairfax India (FI) investments are centrally managed by Hamblin Watsa Investment Counsel Ltd., a wholly owned subsidiary of FFH.

IIFL Finance gave a 25.8 percent return to FI on its investment of $76 million made in December 2015. The fair value of this investment was $412 million at the end of December 2023. It has a stake of 15.1 percent in the non-bank financial sector. business.

Fairchem Organics returned FI a 23.3 percent return on the $30 million investment made in February 2016. The fair value of this investment was $103 million. FI holds a 52.8 percent stake in the company.

5paise gave a 22.5 percent return to FI on the $17 million investment it made in December 2015. The fair value of this investment was $52 million. FI holds a 24.6 percent stake in the company.

The $170 million investment made in CSB Bank in October 2018 earned FI a 20 percent return. The fair value of this investment was $409 million at the end of December 2023. FI holds a 49.7 percent stake in the private sector bank.

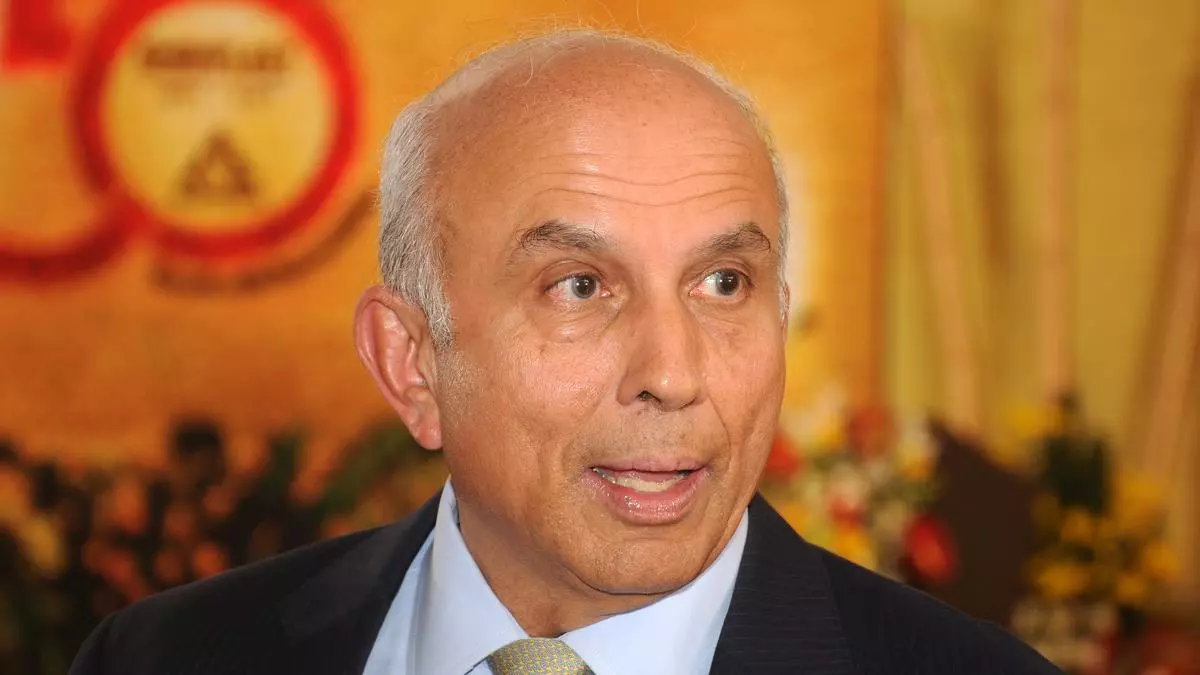

V Prem Watsa, Chief Executive Officer and Founder of FFH, in his letter to shareholders, observed that the Indian economy is expected to grow at 7 per cent in the foreseeable future, the highest growth rate for a major economy. “In the next four years, India is expected to become the world’s third largest economy behind the United States and China and ahead of Japan and Germany.

“Modi should easily be re-elected in May this year – perhaps even with a larger majority than in his second term. This will clearly make India a business-friendly nation with great prospects for the future. It is very unlikely that India will return to the socialist ways that were in place when I left India 51 years ago! » said Watsa.

“Tvaholic. Beer guru. Lifelong internet nerd. Infuriatingly humble pop culture scholar. Friendly food advocate. Freelance alcohol fan. Incurable bacon ninja.”

:strip_icc():format(jpeg)/kly-media-production/medias/4953136/original/060929700_1727279642-Screenshot_2024-09-25_224617.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/3306276/original/047015900_1606275972-CjkinzN007013_20201125_CBPFN0A001.jpg)